💸 Economic Considerations to Optimize Your Remote Work Perk

Make the most of your remote work perk by properly comparing locations and understanding the hacks to maximize your net disposable income when you move

👋 Welcome to Gray Matters 🧠, a newsletter where we share interesting reflections about Tech, Software, and Productivity.

If you enjoy this and are not yet subscribed, please consider signing up. It will sincerely make our day.

While the COVID19 pandemic has brought misery and pain to many, it also created the ideal conditions for companies to finally embrace going fully remote, not only for the duration of the pandemic but for the long term. Many Silicon Valley companies like Twitter, Facebook, Shopify, and Slack have announced that they will allow their employees to work remotely permanently.

As I was contemplating taking advantage of this new perk myself, many questions started coming to mind about what factors should I take into account and how could I maximize the "take-home savings" (or disposable income) if I moved.

What follows is a pretty in-depth analysis of the considerations I would make when thinking to move, alongside some insights on how to optimize your move, including what I call the "equity loophole". I will start by describing concepts that I will later use as building blocks for the more insightful and complex sections towards the end, so feel free to skip ahead if you find any section boring.

I will use the example of moving within the United States in the post, but all the concepts and considerations apply to any kind of move. Also, most of the vocabulary is borrowed from Gitlab's excellent Compensation Calculator.

Salary adjustment

Bad news first: most companies won't pay you the same to work from San Francisco or to work from Salt Lake City -- even if you do the same job and produce the same output. Sadly for those of us who want to move out of an expensive area, the vast majority of companies adjust your salary to "preserve your purchasing power" or by adjusting your salary to match the market rate of the target location.

Some times the salary adjustment is expressed as an adjustment factor or "location factor", so I will adopt this notation from now on. For example, if you decide to move to Hawaii, you might get a location factor of 0.7 or 0.8 of what an engineer working in San Francisco would make.

So, assuming you have equity as part of your compensation, you can calculate your new compensation as follows:

NewYearlyComp = ((CurrentYearlySalary + CurrentYearlyBonus) * LocationFactor) + CurrentEquityCompensationPerYear

The formula ignores taxes for now, and it assumes that bonus and other non-salary compensation will stay constant.

If you are lucky enough to work at a company that allows remote work and which won't adjust your salary by location, you've struck gold. It's basically the best position to be in as you have all the cards stacked on your favor, especially if they allow you to move internationally, which would make the opportunities of location arbitrage even bigger — assuming you want to take advantage of that opportunity, of course.

Knowing how much your company will adjust your salary is the most important piece of information when considering your move. Some companies make it more transparent than others, but your manager should be able to provide you what your new salary would be for a given target location.

Taxes

Comparing pre-tax amounts can be a bit deceiving, so let's deal with the taxes now so we can compare apples to apples in the following sections.

The tax that will have the biggest impact in your move is the State Income Tax:

Sadly there's no straightforward way of incorporating the tax variation in the calculations: no matter how you do it, you will still need to manually calculate the new expected combined tax rate (i.e. factoring in both the Federal and State effective tax rates) for the target location.

Incorporating that in the previous formula gives us:

NewNetYearlyComp = ((CurrentYearlySalary + CurrentYearlyBonus) * LocationFactor * (1 - NewCombinedEffactiveTaxRate)) + CurrentEquityCompensationPerYear * (1 - NewCombinedEffactiveTaxRate)

* (Of course this is ignoring that Equity will probably have more complex tax implications, but I am trying to keep it as simple and less boring possible 😬)

Don't be fooled by the lure of low-income-tax states though, the same way you are factoring their inexistent income taxes into your calculations, salaries in those locales reflect that reality by being lower than in other places. There's no (easy) free lunch.

Other taxes to be aware of -- especially if you plan to own a home -- are the property taxes, but I will not get into those weeds here as it doesn't have an outsized impact.

Disposable Income by location

We finally get to what we really want to know: how much disposable income we will have at the end of the year in the new location, i.e. if you will end up having more or less money at the end of the year.

First, you need to know our current disposable income. This should be easy enough: apply the previous formula for NetYearlyComp to the current location, and subtract current yearly expenses:

CurrentNetDisposableIncome = CurrentNetYearlyComp - CurrentYearlyExpenses

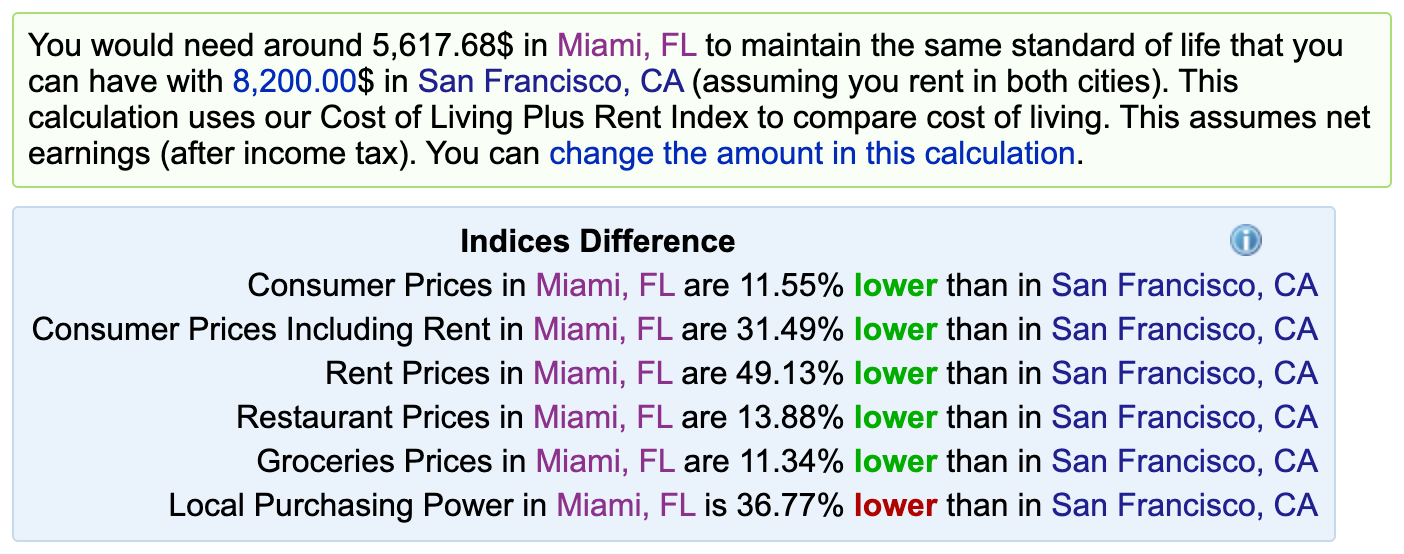

In order to calculate the NewDisposableIncome for the target location, I use a CostOfLivingFactor to approximately calculate how my expenses will grow or shrink in the target location. This is obviously a rough estimate but it's better than nothing. To do so, you can check websites like Numbeo or Expatistan where you can select your current city and the target city, and it will tell you the relative change in cost of living:

If you are renting and planning to continue doing so, it's pretty straightforward: just take the "Consumer Prices Including Rent" and transform it into a factor you can multiply your expenses by. Taking the numbers from above:

CostOfLivingFactor = 1 - 0.3149 = 0.6851

This means that if you currently spend $50k a year, you would only need to spend, roughly, $34k to keep the same standard of living in the new location.

If you are a homeowner or are planning to buy a house, you need to make sure you factor that into your calculation, but I would probably treat the profits or losses of the real state transaction as a lump sum (I guess you could amortize the profit/loss over some years if you really want to get fancy, but I will not open that can of worms here).

Once you have the cost of living factor calculated, you can calculate your new disposable income as follows (assuming you will maintain the same standard of living):

NewDisposableIncome = NewNetYerlyComp - (CurrentExpenses * CostOfLivingFactor)

Now you are in a pretty good place where you can easily compare the CurrentDisposableIncome with the NewDisposableIncome.

Find the boundaries

Now let's talk a bit about optimizations for people who are willing to be flexible about where they live in order to maximize their savings at the end of the year.

How could one exploit the system of salary adjustment by location? A way I've already seen some people use is to find the outer "boundaries" of high-paying areas like NYC or the Bay Area, where real estate is much cheaper than in the center of those areas while keeping the highest pay band.

This technique exploits the fact that companies can't have infinitely granular salary market rate data: as far as I know, most companies have a "salary granularity" of, at most, city or metropolitan area level where only cities and areas where the cost of living is high (compared to the State) are singled out, while the rest of the state gets its own LocationFactor.

We can see an example of this in the Gitlab Salary calculator:

This approach works especially well if you already live in the top-paying area and you just want to move somewhere cheaper not too far from your current location. For example, if you live in San Francisco, the question becomes what does "Bay Area" or "San Francisco" really mean to your HR department? Is Antioch still "Bay Area"? Is Brentwood?

If you don't mind living in places previously deemed less desirable due to their lack of public transportation or long commute to the city, while still being inside the top pay zone, that will probably be your best bet at maximizing your Net Disposable Income. Don't expect as low prices as before COVID-19 though, as many of those areas are already seeing property prices go up.

The more transparent your company is about the salary adjustment and its application zones, the easier it will be to optimize your move to maximize your Disposable Income.

The equity loophole

Lastly, if you look again at the formula for NewYearlyComp you will realize that already granted equity is not affected by the location factor. Your company simply can't adjust your equity grants once those have already been granted (or, at least, I've never heard of this happening).

The importance of this realization is directly proportional to your equity compensation as a share of your salary: the more of your salary that comes from equity, the more of your salary that would stay untouched by the move, (at least until you run out of grants) -- this is, making the simplifying assumption that your equity position is liquid and that the stock price will stay stable. Of course, this is very good for your finances if you are planning to move to a place with a lower Cost of Living.

How many more vestings you have in the pipeline is of course very relevant, as most companies will definitely adjust their "refresher" grants by location similarly to how they adjust your salary. This means that having a relatively fresh initial 4-year grant is close to a perfect scenario, as you could be profiting from it until four years from now in your new, potentially cheaper-to-live-in location before you are even granted a lower refresher grant.

For example, if your salary is $150,000, but make ~$200,000 in equity every year (let's assume the stock price is stable for simplicity), and decide to move to Austin from San Francisco with a location factor of 0.8 and a Cost of Living factor of `0.5626`, your old and new compensations are as follows:

oldCompensation = 150,000 + 200,000 = 350,000

newCompensation = (150,000 * 0.8) + 200,000 = 320,000

While your total compensation is lower, once you calculate the Net Disposable Incomes we see that it's actually a great deal. I will use an assumed 40% effective combined tax rate in CA and a 30% one for TX to be generous (TX has 0% State Income Tax), with $70k yearly expenses:

oldNetDisposableIncome = (350,000 * (1 - 0.40)) - 80,000 = 130,000

newNetDisposableIncome = (320,000 * (1 - 0.3)) - (80,000 * 0.5626) = 199,992

That's a delta of almost $70k after taxes per year, and probably living in a much better place than you would in San Francisco 😅

Surely, the equity loophole is a temporary situation as the edge will wear off once you start getting lower equity refreshers (or even worse: no refreshers 😱), but it's a very important factor to take into consideration.

Please share

This is all I had. I would love to hear any other hacks or insights to optimize your Remote Work perk you may have come up with. Please drop us a comment!

Also, if you liked this article, we’d really appreciate it if you shared it with your friends 🙇♂️

We’ll be back next week with more. Enjoy the rest of your week 🚀